How to help your kids buy their first home

For many Australians, buying a first home has become increasingly challenging.

Rising property prices, high borrowing costs, lack of affordable housing options, and cost of living pressures have made it harder for younger people to save a deposit and qualify for a loan. As a result, many of our clients are asking the same question: “How can I help my kids (or grandkids) get into the property market?”

Fortunately, there are a range of ways you can provide meaningful support—some financial, some strategic, and some simply educational. Below are the most common and effective options worth considering.

Gifting money

One of the simplest ways to help is to gift funds, typically to help cover a deposit or stamp duty. A genuine financial gift can boost your child’s borrowing power and reduce or eliminate the need for Lenders Mortgage Insurance (LMI).

However, there are a few things to keep in mind:

- Most lenders will want to see that gifted funds have been held in your child’s account for at least 3 months (referred to as “genuine savings”).

- Once money is gifted, it’s no longer legally yours. Consider the risks if your child’s current relationship breaks down or their circumstances change.

- It's wise to document the gift clearly, especially if you have multiple children you may want to treat equally over time.

Providing a loan

Rather than gifting money, you may choose to lend funds to your child. This can help protect your interests, especially if you're concerned about future legal or financial complications.

You’ll need a clear, legally documented loan agreement, including:

- The amount borrowed

- Interest rate (if any)

- Repayment terms

- What happens if your child separates from a partner or runs into financial difficulties

It’s important to get legal advice on this to avoid tax issues or misunderstandings down the track.

Offering a family guarantee

Another powerful option is to act as a guarantor on your child’s home loan, often referred to as a family guarantee. Rather than giving or lending money, you offer some of the equity in your own home as additional security for their loan. Benefits include:

- Helping your child avoid paying Lenders Mortgage Insurance (LMI)

- Allowing them to borrow a larger amount or with a smaller deposit

- Keeping your capital intact if the loan is repaid as expected

The risk? If your child defaults on their loan, you are legally responsible for the guaranteed portion. That’s why it is important to have the highest-level of trust in your kids (and their partners) to manage their finances responsibly and to come to you before any problems arise. If their circumstances change and they cannot meet their loan obligations, a mortgage broker or adviser can help minimise your exposure.

A professional financial plan is a thoughtful pre-wedding gift and may raise the need for binding financial agreements to be considered where asset levels differ dramatically between a couple, or their families. Our advisory team can help with this.

Educating and advising

Sometimes the most valuable gift is financial knowledge. Many young buyers feel overwhelmed by the property process, lending options, or managing a budget.

You can:

- Encourage your child to see a qualified financial adviser or mortgage broker.

- Share your own experience (the wins and the mistakes)

- Help them build good financial habits early—budgeting, saving, and understanding debt and their credit score.

Empowering your child to make smart financial decisions can have a longer-lasting impact than financial assistance alone.

Helping your kids get the financial education they didn't get at school.

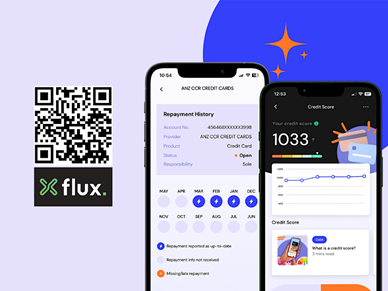

Flux Finance is a popular app already helping more than 400,000 Aussies win at money. We’ve partnered with Flux to offer under 35s our FMD community free access to premium app features that normally require a paid subscription. They can check their credit score and learn simple ways to improve it. Or use the easy budgeting tool, with a consolidated view of all their accounts in one place to get serious about saving.

Use the QR code below to download the Flux/FMD app and get started!

Combining strategies

In many cases, the best solution is a blend of these options. For example:

- Gift a portion of the deposit

- Go guarantor for a limited time

- Cover the cost of independent advice to help them make informed decisions

Every family is different, and the right approach will depend on your own financial situation, your children’s needs, and your comfort with risk.

I've had hundreds of conversations with families wanting to help their adult kids get into to their first home faster during my 20 years as mortgage adviser.

If you’re able to help your children or grandchildren into the property market, it’s worth discussing the options with your adviser. We can help you:

- Understand the financial impact on your own retirement plans

- Structure support in a way that’s fair, sustainable, and legally sound

- Connect your family with professionals to help them succeed

Helping the next generation build security through home ownership can be incredibly rewarding and when done well, it benefits the whole family.

If your adult children have already got that deposit together and they want to get the right loan with plenty of support along the way to help them succeed, they can book a chat with me.

General advice disclaimer: This article has been prepared by FMD Financial and is intended to be a general overview of the subject matter. The information in this article is not intended to be comprehensive and should not be relied upon as such. In preparing this article we have not taken into account the individual objectives or circumstances of any person. Legal, financial and other professional advice should be sought prior to applying the information contained on this article to particular circumstances. FMD Financial, its officers and employees will not be liable for any loss or damage sustained by any person acting in reliance on the information contained on this article. FMD Group Pty Ltd ABN 99 103 115 591 trading as FMD Financial is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977. The FMD advisers are Authorised Representatives of FMD Advisory Services Pty Ltd AFSL 232977. Rev Invest Pty Ltd is a Corporate Authorised Representative of FMD Advisory Services Pty Ltd AFSL 232977.